摘要: By now, it’s more or less an open secret that the good folks at Tether Limited are crooks who have fraudulently pumped the cryptocurrency market in order to...

▲來源:medium.com

By now, it’s more or less an open secret that the good folks at Tether Limited are crooks who have fraudulently pumped the cryptocurrency market in order to enrich themselves and their co-conspirators. If this comes as a surprise to you, or if you’ve heard nothing about it, or if you vehemently disagree, I’m not going to beat a dead horse by explaining it all over again from the beginning, but I would advise you to first read the two articles I’ve already published on the subject (here and here) and/or take a gander at Bitfinex’ed who has been exposing the Tether fraud longer than anyone.

While virtually everyone knows Tether is a fraud, crypto enthusiasts are known to do some serious mental backflips in order to imagine that their investments are safe and sound. A classic crypto fallacy is that history repeats itself precisely; what happened in 2017 is a perfect model to predict what will happen in 2021, and Tether never imploding before means it will never-ever implode in the future. I asked the famed Hieroglyphics rapper “Casual” (whose IG account is full of screenshots of his crypto portfolio) if he was concerned by the Tether situation, and he said, “Nah, people have been talking about that as long as I’ve been in crypto.” His stance is not unique. People have been saying Tether is a fraud for years and nothing has changed— so why should we care? If my number goes up, why should I care what’s causing it to go up?

Well, it seems like we are finally approaching the end of Tether and, with it, the end of the lawless childhood of cryptocurrency in general. A lot has happened since I last wrote about crypto, and all of it suggests that things are on the verge of going south very quickly. Regulation, criminal investigations, tightening nooses — oh my!

1.Wall Street reacted with surprise that Tether supposedly had $30 billion of commercial paper in reserve, making it the 7th largest holder of commercial paper in the world. If they are a top ten holder of commercial paper globally — how has no one in the commercial paper market ever traded with them?

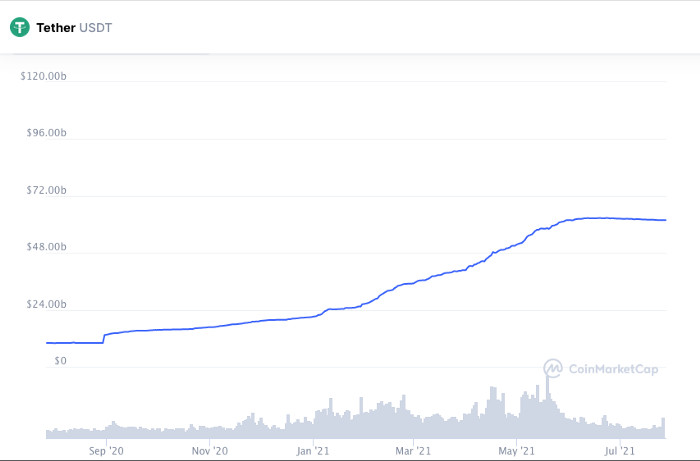

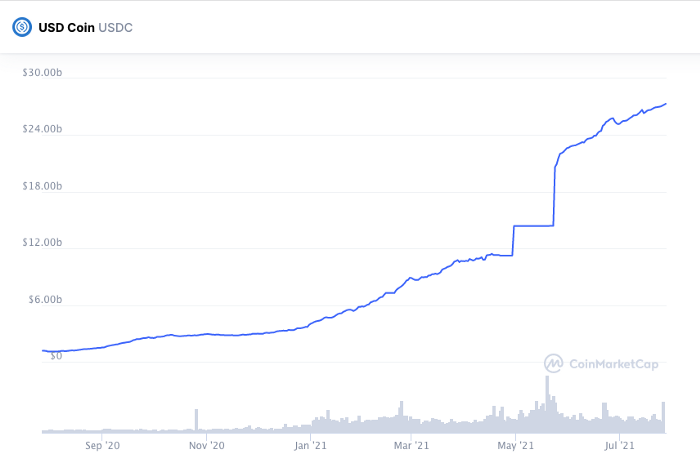

2.After months of printing aggressively, Tether ceased printing their unbacked Tethers on June 11th, dashing any hopes that the market might resume its bull run. Circle’s USDC kept their own printers working overtime, which reinforces the notion that Tether and other stablecoins aren’t issued to meet legitimate demand (their growth trends would be similar over time) and also adds another layer to the Coinbase-Tether connection I explored here.

▲來源:medium.com

▲來源:medium.com

3.The long-time Tether-supporter and world’s largest crypto exchange, Binance, faced a cascade of regulatory action that saw them banned from the UK, the Cayman Islands, Thailand, Japan, Malaysia, and Ontario. Their previous legal status in the UK had been facilitated by an elaborate scheme. Take that with the quiet disappearance of their U.S. CEO, a money laundering investigation by the Justice Department and IRS, widespread withdrawal issues (which suggest liquidity issues), and the fact that their fearless leader CZ admits to running the whole company from ever-changing hotel rooms, and things look very unstable in Binance land.

4.Further rumors emerged that members of Tether staff and executives are a complete fabrication, and the $62 billion company is run almost entirely from CTO Paolo Ardoino’s laptop.

▲來源:medium.com

5.Treasury Secretary Janet Yellen announced that stablecoin regulation would be a regulatory priority moving forward.

6.Tether CTO Paolo Ardoino appeared on a CNBC live stream alongside his lawyer Stuart Hoegner (the non-existent CEO doesn’t do publicity, and it’s always best to have your lawyer present when you’re trying to do PR for a criminal enterprise.) Paolo was visibly nervous and experienced technical issues that some suspected were a means of temporarily escaping the interview. Answers were consistently evasive, even as the two repeatedly emphasized that they are industry leaders in transparency. The top comment on the Youtube live stream says: ‘Transparency’ so thick you can’t see through it.

7.On this Sunday, July 25th, a fake news rumor claimed that Amazon was exploring bitcoin payments and planning to release their own cryptocurrency. The market pumped. Bloomberg reported almost simultaneously that Tether is being investigated by the Department of Justice for bank fraud.

8.On Monday afternoon, Amazon predictably announced that the rumors of their interest in crypto were entirely false (Was the story planted specifically to combat the negative sentiment of the Bloomberg article? Your guess is as good as mine). Tether, meanwhile, made a statement calling the Bloomberg report “stale claims.” They wrote that they “routinely [have] open dialogue with law enforcement agencies, including the U.S. Department of Justice, as part of our commitment to cooperation, transparency, and accountability.” Oh, you know, nothing abnormal here. Federal criminal investigators love to drop in on companies to chit chat and keep in touch.

9.Bloomberg reported today (Tuesday, July 27th) that in closed door meetings with financial regulators, Treasury Secretary Yellen “was particularly concerned about Tether’s claims that it holds massive amounts of commercial paper.” Also per Bloomberg: “Acting Comptroller of the Currency Michael Hsu said regulators are scrutinizing Tether’s stockpile of commercial paper to see whether it fulfills the company’s pledge that each token is backed by the equivalent of one U.S. dollar.”

To summarize:

Tether has fraudulently printed $62 billion of ostensibly dollar-backed tokens that were never actually backed by dollars. They loan these tokens to cryptocurrency exchanges. On receiving these massive loans of Tether, the exchanges give Tether Limited an IOU. Tether Limited claims that commercial paper is backing USDT, but they are deliberately evasive about how they acquired it and what companies have financial obligations to them. If their commercial paper consists of the IOU’s being given by the crypto exchanges, then it is worthless as a backing to USDT, since those exchanges have no significant USD liquidity to underwrite the enormous USDT liquidity. The fact that no one on Wall Street has traded commercial paper with Tether Limited lends more credence to this concern, and if financial regulators are about to investigate the basis of Tether’s commercial paper, then the scam is primed to blow wide open in the near future. Whether the commercial paper is coming from crypto exchanges (as I believe) or from Chinese companies (as others have suggested), an investigation into the source may spell curtains for Tether and the entire crypto market.

Tether’s long-time compatriot Binance, which is the financial leader of the crypto space, is also seemingly on the verge of collapse. They are being banned by an increasing number of countries, they are being investigated for financial crimes, and their corporate infrastructure is being gradually exposed as a lot of smoke and mirrors. When Binance goes — and they might go soon — crypto prices will plunge along with them.

Long story short, it’s an extremely risky moment to have your finances tied up in cryptocurrency, and if you happen to have your crypto stored on an exchange like Binance you are putting yourself doubly at risk. Both of these companies are on the ropes, and if either one implodes, the crypto market will undergo a devastating flash crash. But it isn’t just a concern that your crypto will lose value. If things go south, it’s highly unlikely that you will be able to pull your crypto or fiat out of an imploding crypto exchange, so you could lose every penny that isn’t in your own direct possession. To me, the risks outweigh the potential for reward, and I won’t be touching crypto again until the bomb has exploded and the dust has settled.

轉貼自: medium.com

若喜歡本文,請關注我們的臉書 Please Like our Facebook Page: Big Data In Finance

留下你的回應

以訪客張貼回應